What is an estate tax return?

When you die, you will leave behind all your property (everything you own) and debts (everything you owe). All this is called your estate. After the debts have been paid, the various items left in your estate will be transferred to your heirs and beneficiaries, but first the federal government will take its share through estate taxes (gift and estate tax and generation-skipping transfer tax). The personal representative of your estate must file an estate tax return with the IRS if the value of your gross estate at death together with the value of all taxable gifts you made during life is more than a certain amount ($12,060,000 plus any deceased spousal unused exclusion amount in 2022). The federal estate tax return (Form 706) lets the IRS know how the estate taxes are calculated and how much tax is owed. Generally, the estate tax return must be filed within nine months after your death, but an automatic

six-month extension is available if Form 4768 is filed on or before the due date for filing Form 706. An additional six months may be granted for good cause shown. The late filing penalty is 5 percent of the taxes due per month, up to 25 percent. This is in addition to any late payment penalty.

An estate tax return may also need to be filed with your state. This discussion focuses on the federal return only. Contact your state for information regarding its state death taxes.

Caution: The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act introduced a new portability feature, which allows a surviving spouse to take advantage of the unused applicable exclusion amount of a predeceased spouse who died after December 31, 2010. Normally an estate valued at less than the available exclusion amount would not be required to file an estate tax return; however, a return will now be necessary for nontaxable estates in order to record the amount of a decedent’s unused exclusion amount for a surviving spouse who may want to use it later.

Tip: If you are the owner of a closely held business, your personal representative may be able to defer payment of estate taxes owed on that interest for up to 15 years.

How do you calculate estate tax liability?

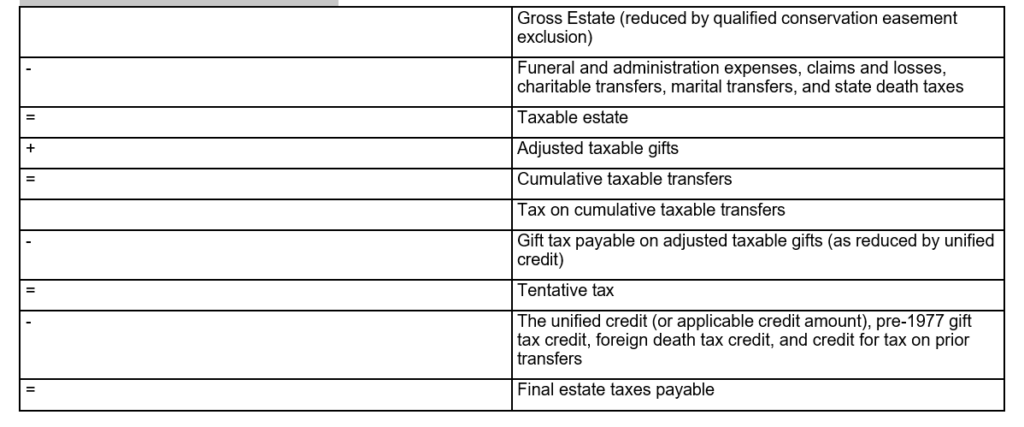

Calculating estate taxes is similar to calculating income taxes. It is basically a four-step process:

- Determine what is taxable

- Determine what isn’t taxable

- Calculate the tentative estate tax

- Subtract allowable credits from the tentative tax The calculation looks something like this:

How do you file an estate tax return?

The following explains how to fill out Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return and the various attachments.

Caution: This discussion here is for information purposes only. Do not attempt to complete an estate tax return based solely on the information provided here. Please consult Form 706 and the instructions to Form 706 for further information. You may also wish to consult an attorney or tax professional before filing an estate tax return.

Part 1 — Decedent and Executor

This section is looking for identifying information about the decedent, including name, Social Security number, domicile at time of death, year domicile was established, date of birth, and date of death. The executor’s or administrator’s name, address, and Social Security number must also be supplied. Additional questions ask whether the decedent left a will, the name and location of the court where the will was probated or the estate was administered, and the case number.

Part 2 — Tax Computation

This section is completed last as it contains information from other sections of the return and the applicable Schedules. After adding adjusted taxable gifts and subtracting allowable deductions from the gross estate, you will calculate a tentative tax (or gross estate tax). The estate taxes will then be reduced by available credits. When all the calculations are complete, the number on the bottom line of this section is what the estate owes the IRS.

Part 3 — Elections by the Executor

Generally, the value of your gross estate is the fair market value of all property on the date of your death. However, if your estate qualifies, your personal representative may elect the alternate valuation date that allows the gross estate to be valued six months after the date of death or on the date an asset is disposed of, whichever is earlier. The purpose of the alternate valuation date is to permit a reduction of the tax liability if the value of the estate’s property has decreased since the date of death. Special use valuation may also be available for certain farm and closely held business real property. This election allows the property to be valued at its actual value, rather than at its fair market value. Certain other elections may be made on this part of the form as well.

Part 4 — General Information

This section includes information about the decedent’s occupation and marital status, along with information about the surviving spouse and the beneficiaries of the estate, such as children and grandchildren. There are also questions about whether gift tax returns have been filed and what types of property were owned by the decedent.

Part 5 — Recapitulation

This is the section where the gross estate and allowable deductions are calculated. Totals from various schedules are entered to make this calculation. Every line must be filled in, even if the entry is 0. Do not enter anything in the Alternate Value column unless the alternate valuation date is elected. Attach the appropriate Schedule for each item in Part 5.

Part 6 — Portability of Deceased Spousal Unused Exclusion Amount (DSUEA)

An election to transfer the unused applicable exclusion amount of the decedent to the surviving spouse can be made here. Also, the DSUEA received by the decedent from a predeceased spouse and applied against lifetime gifts are listed and a total calculated in Part 6.

Schedule A — Real Estate

Provide the address and legal description of all real estate owned by the decedent. If the estate is liable for a mortgage, report the full value of the property in the value column without subtracting the mortgage liability. Show the amount of the mortgage in the description column. The amount of the unpaid mortgage is subtracted on Schedule K.

Schedule B — Stocks and Bonds

Report all stocks and bonds owned by the decedent, including the face amount of bonds, number of shares of stock, unit value, and value as of the date of death (or alternate valuation date, if elected).

Schedule C — Mortgages, Notes, and Cash

Use Schedule C to report mortgages, promissory notes, and cash items held by the decedent at the time of death. Include a description of each item (e.g., the amount of a mortgage, its unpaid balance and the origination date, the borrower and the lender, the location of the mortgaged property, the interest rate). Cash on hand should be reported, as well as the balances of any checking or savings accounts held by the decedent.

Schedule D — Insurance on the Decedent’s Life

Schedule D must be completed if there is insurance on the decedent’s life, regardless of whether it is included in the gross estate. If the decedent possessed any incidents of ownership at death, those policies must be reported, whether the proceeds are

payable to the estate (or for the benefit of the estate) or to any other beneficiary.

Schedule E — Jointly Owned Property

All jointly owned property must be reported on Schedule E, regardless of whether the property is included in the gross estate. For the purposes of this form, jointly owned property includes property of any type in which the decedent held an interest as a joint tenant with right of survivorship or as a tenant by the entirety.

Schedule F — Other Miscellaneous Property

Schedule F covers all property included in the gross estate that is not listed elsewhere, such as tangible personal property, business interests, and insurance on the life of another. This schedule must be attached, even if there is no miscellaneous property to report, because it contains questions that must be answered about art, collectibles, bonuses, awards, and safe deposit boxes.

Schedule G — Transfers during Decedent’s Life

The following transfers should be reported on Schedule G:

- Gift taxes paid on gifts made by the decedent or the decedent’s spouse within three years before death

- Transfer of life insurance policies made within three years before death

- Transfer of life estate, reversionary interest, or power to revoke within three years before death

- Transfers with retained life estate where the decedent retains the right to designate a beneficiary of the property transferred

- Transfers taking effect at death

- Revocable transfers

Schedule H — Powers of Appointment

If the decedent possessed any powers of appointment, Schedule H must be completed. A power of appointment means that you have the power to determine who will own or enjoy the property subject to the power. The power must be created by someone other than the decedent. If you answered Yes to line 13 of Part 4, then General Information, Schedule H must also be completed.

Schedule I — Annuities

Annuities owned by the decedent are reported on Schedule I. Any annuity must be included in the gross estate if it meets the following requirements:

- It is receivable by a beneficiary following the death of the decedent by virtue of surviving the decedent

- It is under contract or agreement entered into after March 3, 1931

- It was payable to the decedent, either alone or in conjunction with another, for the decedent’s life, or a period not ascertainable without reference to the decedent’s death, or for a period that did not end before the decedent’s death

- The contract or agreement is not an insurance policy on the life of the decedent

Many retirement plan benefits constitute annuities, and Schedule I is the proper place to list these benefits.

Schedule J — Funeral Expenses and Expenses Incurred in Administering Property Subject to Claims

Various deductible expenses and fees associated with managing the estate are itemized on Schedule J. Items to be reported on this form include funeral expenses, executor’s fees, attorney’s fees, certain interest expenses incurred after the decedent’s death, and miscellaneous expenses incurred in preserving and administering the estate.

Schedule K — Debts of the Decedent, and Mortgages and Liens

Debts of the decedent on the date of death are deducted on Schedule K. Debts of the estate incurred after the date of death are not reported on Schedule K.

Schedule L — Net Losses during Administration and Expenses Incurred in Administering Property Not Subject to Claims

Losses that will not be claimed on a federal income tax return are itemized on Schedule L. These items include losses from thefts, fires, storms, shipwrecks, or other casualties that occurred during the settlement of the estate. Expenses other than those listed on Schedule J are also reported on Schedule L, whether these expenses are estimated, agreed upon, or paid.

Schedule M — Bequests, etc., to Surviving Spouse

Property interests passing to the surviving spouse are reported on Schedule M. This item includes property interests the spouse receives by any of the following methods.

- As the decedent’s heir, donee, legatee, or devisee

- As the decedent’s surviving joint tenant or tenant by the entirety

- As beneficiary of life insurance on the decedent’s life

- Under dower or curtesy or similar statute

- As a transferee of a transfer made by the decedent at any time

- As beneficiary of a trust created and funded by the decedent, provided the trust contains certain specified provisions for the spouse

Only property that is included in the decedent’s gross estate can be claimed as a deduction using Schedule M.

Schedule O — Charitable, Public, and Similar Gifts and Bequests

Charitable gifts deducted from the gross estate are itemized on Schedule O. You must also provide a statement that shows the values of all legacies and devises for both charitable and noncharitable use, the date of birth of all life tenants or annuitants, a statement showing the value of all property that is included in the gross estate but does not pass under the will, and any other important information.

Schedule P — Credit for Foreign Death Taxes

If death taxes are being paid to any foreign country, these amounts must be reported on Schedule P to claim a credit against the gross estate. All amounts paid or to be paid for foreign death taxes must be entered in United States currency.

Schedule Q — Credit for Tax on Prior Transfers

If the decedent received property from a transferor who died within 10 years before or 2 years after the decedent, a partial credit is allowable for the taxes paid by the transferor’s estate. This credit is calculated using Schedule Q.

Schedule R — Generation-Skipping Transfer (GST) Tax

Schedule R is used to calculate the generation-skipping transfer (GST) tax that is payable by the estate. GST tax is typically imposed on property transferred to an individual who is two or more generations below the decedent. For purposes of Form 706, property interests being transferred must be includable in the gross estate before they are subject to the GST tax.

Schedule U — Qualified Conservation Easement Exclusion

A portion of the value of land that is subject to a qualified conservation easement may be excluded from a decedent’s gross estate. Schedule U is used to make this election.

Schedule PC — Protective Claim for Refund

Schedule PC can be used to preserve the estate’s right to claim a refund based on the amount of an unresolved claim or expense that may not become deductible under Section 2053 until after the limitation period ends.

Where can you get help filing an estate tax return?

There are many professionals who can assist you in filing an estate tax return, including your attorney, your tax professional, or your financial advisor. In addition, there are now software products designed to guide you through the process of filling out an estate tax return.

Important Disclosures

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The information provided is not intended to be a substitute for specific individualized tax planning or legal advice. We suggest that you consult with a qualified tax or legal professional.

LPL Financial Representatives offer access to Trust Services through The Private Trust Company N.A., an affiliate of LPL Financial.

This article was prepared by Broadridge.

LPL Tracking #1-05139754