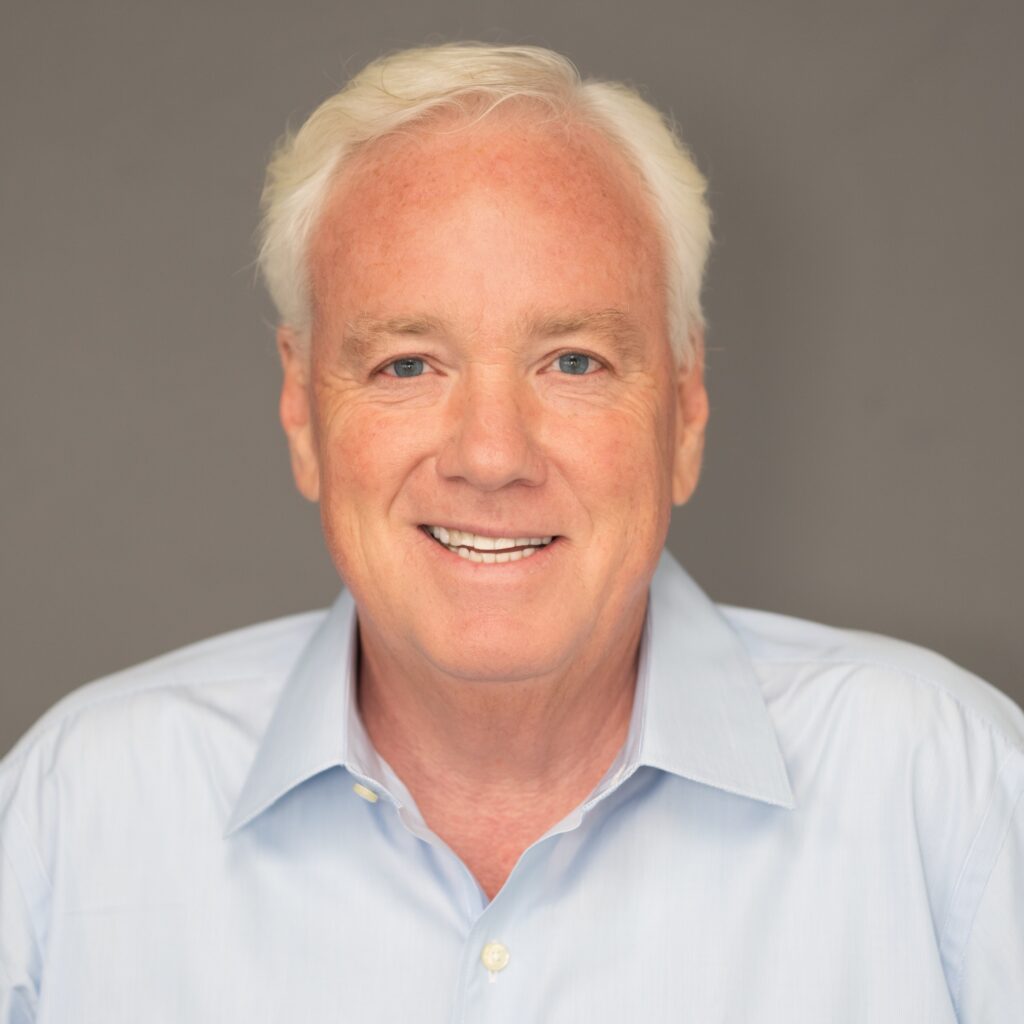

Michael Milam, Financial Advisor, CPA, MAcc

President and CEO

Planning for Business Expansion

Planning for business expansion includes anticipating the need for expansion, analyzing the appropriateness of a capital expenditure or a loan, securing appropriate financing in a timely fashion, and implementing the plan. Effective planning also involves an analysis of your current assets, debts, and profit levels as well as a projection of the necessary assets, debts, and profit potential of your expanded business.

Five Ways SECURE 2.0 Changes the Required Minimum Distribution Rules

The SECURE Act 2.0 legislation has changed the landscape when it comes to RMDs (required minimum distributions) – but what does this actually mean for those planning for retirement?

Retiring as a Small-Business Owner: What to Know Before You Go

The thought of retiring may be intimidating for anyone—but if you own your own business, handing your “baby” to new owners might be enough to stop you in your tracks. What might you do to set your successor up for success? What should all business owners know before they go?

3 Ways Life Insurance Can Help Small Business Owners

Life insurance benefits small business owners and their heirs in many ways, from providing for loved ones to providing financial stability to your company after you’re gone. On our blog we discuss some of the reasons small business owners should carry one or more life insurance policies for their business.

Buying an Existing Business

If you’ve ever wanted to become an entrepreneur without starting from scratch, buying an existing business could be your ticket. This guide will help you through every step of the process, so that purchasing your dream business can become a reality!

Michael D. Milam

President & CEO, Financial Advisor

818-749-7201

[email protected]

Read The Weekly Market Commentary

Michael D. Milam CPA, MAcc, has been associated with California Financial Partners and LPL Financial for over 18 years. He holds his Series 7 and 66 registrations with LPL Financial. He enjoys working closely with clients to provide comprehensive wealth management.

In addition to providing portfolio management to high net worth clients, Mike brings a unique perspective to the financial planning and wealth management process. His background as a certified public accountant and many years of experience with income, estate, trust and gift taxation, provides his clients with a comprehensive approach to all aspects of financial planning. Because of his unique experience, he brings significant value to his clients.

Mike has spoken nationally on tax planning techniques and the planning process. In addition, Mike has testified as an expert witness in the Los Angeles Superior Court system on income, estate and trust taxation, accounting and finance.

His years of experience with individual, trust, estate, corporate, partnership tax planning and compliance provides him with the necessary tools to assist business owners and individuals through all phases of the financial planning process. He has developed many complex succession plans and sophisticated estate planning strategies. As a trusted advisor, he continually works hard to find strategies to pursue the goals of his clients.

Mike was a founding partner in the firm Milam, Knecht & Warner, LLP, a full service CPA and consulting firm. Mike has a bachelor’s degree in accounting and a master’s degree in taxation and accounting. He began his career at Ernst & Young. He was also a senior vice president and CFO with LCF, a diverse holding and asset management company.

When Mike is not working, he enjoys being with his wife, five children (and their spouses) and 14 young grandchildren. He loves traveling, hiking and fishing. He donates time to various charities and youth groups. He finds that helping others is the key to life.

What you get by achieving your goals is not as important as what you become by achieving your goals.

—Zig Ziglar

Michael D. Milam is a Registered Representative with, and securities are offered through LPL Financial. Member FINRA/SIPC.

Check the background of investment professionals associated with this site on FINRA’s BrokerCheck.

DO NOT place orders to buy or sell securities via e-mail or voice mail. This and all other time sensitive requests should be placed directly with your Investment Advisor Representative by telephone.