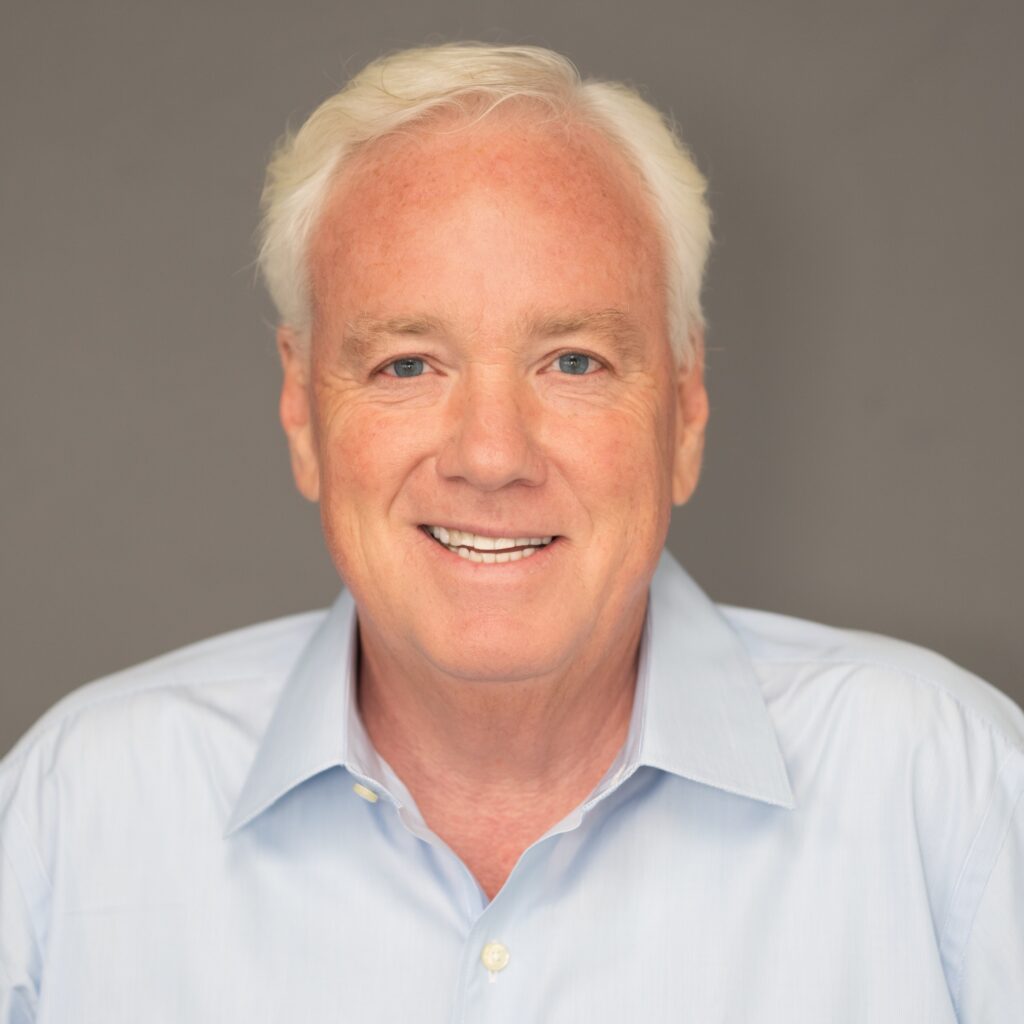

Michael Milam, Financial Advisor, CPA, MAcc

President and CEO

From Riches To Rags In Three Generations: Managing Generational Wealth Checklist

Generational wealth encompasses financial assets with a monetary value. These include investments, real estate, land, cash, collectibles, etc., that are passed from generation to generation. Why does wealth seem to disappear within three generations? Find out on our blog

The Tax Benefits of a Backdoor Roth IRA for High Earners

A Backdoor Roth IRA is a strategy that allows people who earn too much to directly contribute to a Roth IRA to still contribute to one indirectly. This strategy takes advantage of a loophole in the tax code that allows individuals to convert their traditional IRA to a Roth IRA, regardless of their income level.

Building a Company without Adequate Insurance

You never know when a disaster may strike causing severe damage and disruption to your business operations. In order to manage your risks accordingly, business insurance should be factored into your regular cost of doing business. Check out our blog to learn more about the different types of coverage able to help preserve your business.

What You Should Know About the SECURE Act 2.0

Do you know if the Secure Act 2.0 impacts you or your financial and retirement goals? Read our blog for a helpful overview of important information to know about the SECURE Act 2.0.

What Does The SECURE Act 2.0 Mean For Small Businesses?

The SECURE Act 2.0 was signed into law on December 29, 2022, which will work to close the retirement savings gap with over 90 new retirement provisions. The bill includes a few specific changes that are significant for small businesses.

Michael D. Milam

President & CEO, Financial Advisor

818-749-7201

[email protected]

Read The Weekly Market Commentary

Michael D. Milam CPA, MAcc, has been associated with California Financial Partners and LPL Financial for over 18 years. He holds his Series 7 and 66 registrations with LPL Financial. He enjoys working closely with clients to provide comprehensive wealth management.

In addition to providing portfolio management to high net worth clients, Mike brings a unique perspective to the financial planning and wealth management process. His background as a certified public accountant and many years of experience with income, estate, trust and gift taxation, provides his clients with a comprehensive approach to all aspects of financial planning. Because of his unique experience, he brings significant value to his clients.

Mike has spoken nationally on tax planning techniques and the planning process. In addition, Mike has testified as an expert witness in the Los Angeles Superior Court system on income, estate and trust taxation, accounting and finance.

His years of experience with individual, trust, estate, corporate, partnership tax planning and compliance provides him with the necessary tools to assist business owners and individuals through all phases of the financial planning process. He has developed many complex succession plans and sophisticated estate planning strategies. As a trusted advisor, he continually works hard to find strategies to pursue the goals of his clients.

Mike was a founding partner in the firm Milam, Knecht & Warner, LLP, a full service CPA and consulting firm. Mike has a bachelor’s degree in accounting and a master’s degree in taxation and accounting. He began his career at Ernst & Young. He was also a senior vice president and CFO with LCF, a diverse holding and asset management company.

When Mike is not working, he enjoys being with his wife, five children (and their spouses) and 14 young grandchildren. He loves traveling, hiking and fishing. He donates time to various charities and youth groups. He finds that helping others is the key to life.

What you get by achieving your goals is not as important as what you become by achieving your goals.

—Zig Ziglar

Michael D. Milam is a Registered Representative with, and securities are offered through LPL Financial. Member FINRA/SIPC.

Check the background of investment professionals associated with this site on FINRA’s BrokerCheck.

DO NOT place orders to buy or sell securities via e-mail or voice mail. This and all other time sensitive requests should be placed directly with your Investment Advisor Representative by telephone.