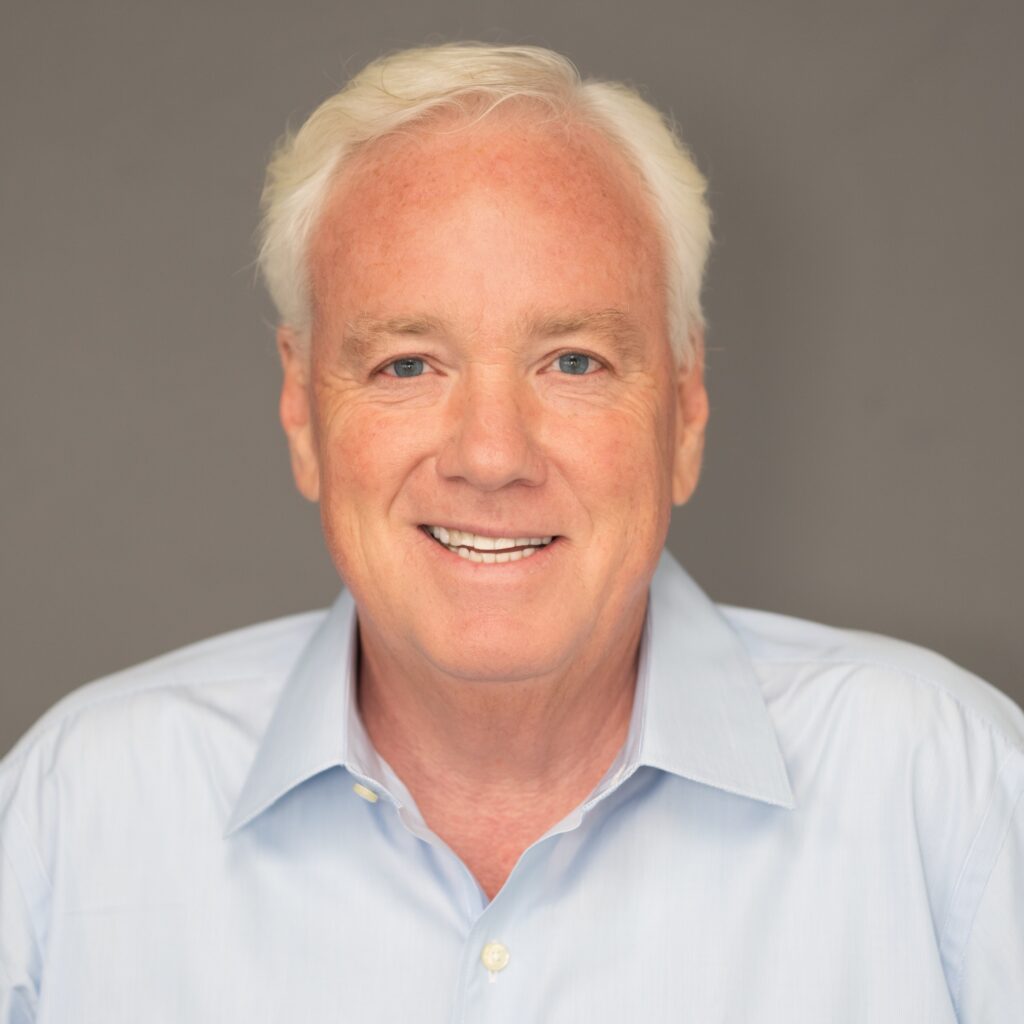

Michael Milam, Financial Advisor, CPA, MAcc

President and CEO

Thinking About Working in Retirement? Here’s What to Consider

Planning on working during retirement? If so, you’re not alone. An increasing number of employees nearing retirement plan to work at least some period of time during their retirement years. Learn how this decision could impact things like your Social Security payments, pension, and health benefits.

Tips for Growing (and Preserving) Your Family Business

When you’re first starting out with your own business, you’re likely to be focused more on staying afloat than on contingency planning. But as your family business expands and grows, it’s important to ensure that this is done in a sustainable way. On our blog we discuss a few tips and tricks to consider to grow—and preserve—your family business.

Executive Compensation: Equity Compensation for Corporate Executives

While equity compensation might be the ideal way to entice sought-after talent, the process comes with both risks and rewards for employers, and employees, which should be taken into consideration before a decision is made.

Tax Prep Checklist: Everything You Need to Be Ready for Tax Season

It’s never too early to get started on tax preparation, so why not start today? Check out our article on everything you’ll need to be ready for tax season.

Business Planning for Continuity

Planning and timely review are the keys to assuring the smooth continuation of a business and providing the needed security for those involved—the owner, his or her family, employees, customers, and even business creditors.

Michael D. Milam

President & CEO, Financial Advisor

818-749-7201

[email protected]

Read The Weekly Market Commentary

Michael D. Milam CPA, MAcc, has been associated with California Financial Partners and LPL Financial for over 18 years. He holds his Series 7 and 66 registrations with LPL Financial. He enjoys working closely with clients to provide comprehensive wealth management.

In addition to providing portfolio management to high net worth clients, Mike brings a unique perspective to the financial planning and wealth management process. His background as a certified public accountant and many years of experience with income, estate, trust and gift taxation, provides his clients with a comprehensive approach to all aspects of financial planning. Because of his unique experience, he brings significant value to his clients.

Mike has spoken nationally on tax planning techniques and the planning process. In addition, Mike has testified as an expert witness in the Los Angeles Superior Court system on income, estate and trust taxation, accounting and finance.

His years of experience with individual, trust, estate, corporate, partnership tax planning and compliance provides him with the necessary tools to assist business owners and individuals through all phases of the financial planning process. He has developed many complex succession plans and sophisticated estate planning strategies. As a trusted advisor, he continually works hard to find strategies to pursue the goals of his clients.

Mike was a founding partner in the firm Milam, Knecht & Warner, LLP, a full service CPA and consulting firm. Mike has a bachelor’s degree in accounting and a master’s degree in taxation and accounting. He began his career at Ernst & Young. He was also a senior vice president and CFO with LCF, a diverse holding and asset management company.

When Mike is not working, he enjoys being with his wife, five children (and their spouses) and 14 young grandchildren. He loves traveling, hiking and fishing. He donates time to various charities and youth groups. He finds that helping others is the key to life.

What you get by achieving your goals is not as important as what you become by achieving your goals.

—Zig Ziglar

Michael D. Milam is a Registered Representative with, and securities are offered through LPL Financial. Member FINRA/SIPC.

Check the background of investment professionals associated with this site on FINRA’s BrokerCheck.

DO NOT place orders to buy or sell securities via e-mail or voice mail. This and all other time sensitive requests should be placed directly with your Investment Advisor Representative by telephone.