On the one hand, there is [fill in the blank]; but on the other hand, there is…

Starting with the last week in July and for the first three weeks of August, investors celebrated that the S&P 500 had advanced for four consecutive weeks, culminating with it passing its pre-COVID peak from February 19th on August 17th.

For perspective, recall that the S&P 500 closed at a then record high of 3,386 on February 19th and just three short and very painful weeks later, the S&P closed under 2,500, a drop of 26% in about 16 sessions.

Then, on August 17th, the S&P 500 eclipsed that February 19th high in mid-morning trading, and it managed to mostly stay there. With a rally of near 50% since the lows of March, the S&P 500 is now in positive territory year-to-date.

Fastest Bear and 2nd Fastest Recovery

Yet while the positive YTD number for the S&P 500 is welcomed of course, it is also worth remembering when the COVID-shutdown led to the fastest-ever bear market from market peak.

Because now that the S&P 500 has officially passed its February high, it will go down as the second fastest bear market recovery in the past 50 years.

In fact, according to Dow Jones Market Data, the 126 trading days it took for the S&P 500 to reclaim its February high was over 10 times as fast as the index’s average historical rebound (1,542 trading days).

A Different Economy Right Now

It seems as if the economic data of the past few weeks has been more positive versus negative. But it also seems as if every positive economic data set can be coupled with a negative data set too:

· On the one hand, housing is red-hot, retail sales are improving, interest rates are very low and there are plenty of bright spots among corporate earnings reports.

· On the other hand, unemployment is very high, the U.S. government has pumped trillions of dollars into propping up the economy and that might be ending and there are plenty of ugly spots among corporate earnings reports.

Yet despite the seemingly contradicting economic data, most everyone would agree that a post-pandemic recovery is occurring. It is the pace at which the recovery is occurring and how long a recovery might last, however, that brings plenty of disagreement among smart investors.

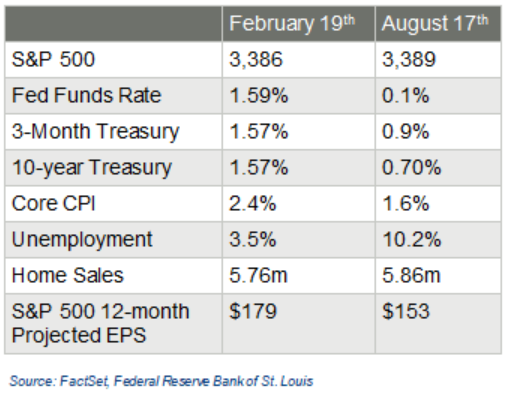

Let’s compare economic data today with where we were pre-COVID to better understand the current investing landscape and where it might trend.

Why Perspective Matters

Glass half-full-investors will undoubtedly focus on the good news – the worst decline in our economy since the Great Depression took just 126 days to recover. And glass-half-empty investors will undoubtedly focus on the not so good news – weekly initial jobless claims hovering around 1 million and close to 30 million unemployed. And long-term investors would be well served understanding both perspectives.

Consider this simple bittersweet example:

· You have $10,000 in your retirement account on February 19th and a month later your online statement shows a value of $7,000.

· About five months later, you open up your account statement and you see a value of $10,500.

· You do some quick math and marvel at how your investments went up 50% from the bottom.

Be honest, how does this make you feel? Probably happy on the one hand, less so on the other, right?

On the One Hand, But Then on the Other

What should you do? Well, the answer to that question, of course, is deeply personal. That being said, it’s never a bad idea to better understand the current macro-economic environment to help make informed decisions. Maybe you can take the “on the one hand, but then on the other” approach?

Something like this:

· One the one hand, it was the fastest bull to bear market in history; but on the other hand, it was the second fastest bear market recovery in history.

· On the one hand, consumer confidence is softening; but on the other hand, housing is red-hot.

· On the one hand, interest rates are stunningly low; but on the other hand, fixed-income investments are offering very low yields.

· On the one hand, the price of oil appears to have stabilized in the low $40s/barrel; on the other hand, the price of gold continues to push to new highs:

· On the one hand, manufacturing activity is improving; but on the other hand, it’s still below pre-pandemic levels.

· On the one hand, unemployment is at historical highs; but on the other hand, the overall trend line is showing signs of improvement.

We could play this game all day.

But the important point is that all this economic data is helpful as it informs your long-term investing decisions and asset allocations. But before you make any investing changes, make sure you talk to your financial professional to help ensure that your assumptions are consistent with your risk profile and your financial plan.

Important Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial professional prior to investing.

All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Asset allocation does not ensure a profit or protect against a loss.

This article was published by RSW Publishing.

LPL Tracking 01-05048224