One key predictor of downturns in the economy is what is known as the yield curve. This typically refers to the market for what the US government borrows, by issuing bonds and other securities that mature over different time horizons ranging from weeks to 30 years.Each of these securities has its own yield (or interest […]

Have We Really Seen Extreme Pessimism Yet?

It’s been a very tough start to the year with both stocks and bonds down sharply. Adding to the “wall of worry” for investors are the highest levels of U.S. inflation in decades, an aggressive Federal Reserve (Fed), Chinese lockdowns, and continuing war in Europe. So perhaps it is no surprise that investor sentiment polls […]

Is the Russia-Ukraine War a Threat to the Global Economy

Before Russia stunned the world by invading Ukraine, it was widely believed that the economic ties formed through globalization would help promote peace. But the war is testing that assumption and drawing attention to the vulnerabilities in far-flung supply chains, which were already under pressure because of the pandemic and recovery. In response to the […]

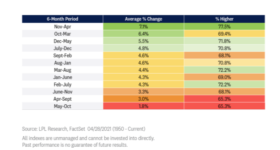

WHY YOU SHOULDN’T SELL IN MAY THIS

YEAR

Sell in May and go away” is probably the most widely cited stock market cliché in history. Every year a barrage of Wall Street commentaries, media stories, and investor questions flood in about the popular stock market adage. In this week’s Weekly Market Commentary, we tackle this commonly cited seasonal pattern and why it might […]

Businesses and Consumers Likely Protected From Near-Term Recession

Not all recessions are created equal. Previous downturns in the U.S. were prompted by various shocks, with the most recent recession started by health and government-induced shutdowns. Other recessions started in the corporate sector, whereas some started from commodity shocks. The next one could start from geopolitical tensions. Nonetheless, we think the current business and […]

- « Previous Page

- 1

- …

- 25

- 26

- 27

- 28

- 29

- …

- 73

- Next Page »