Initial public offerings (IPOs) can present some of the market’s greatest potential investments. Well-known IPOs include Microsoft and Apple Computer in the ’80s, many dot coms in the ’90s, and many household names you recognize today (Facebook).

But it is relatively rare that IPOs provide once-in-a-lifetime opportunities. In fact, IPO values can have extreme fluctuations, so here are some facts you will want to know.

The Mechanics of an IPO

An initial public offering is the term used when a privately-held company offers stock to the public for the first time. IPOs are more common among newer companies, but slightly older privately-held companies may also decide to “go public” (this is what Facebook did for example).

A start-up company may use an IPO to raise capital to see it through a critical early development phase. On the other hand, a larger, more mature company may decide to use a stock offering to raise cash (rather than borrow) for expansion or to acquire a new business, particularly if existing debt levels make conventional borrowing difficult. In some cases, a company that initially goes public is later bought out by private investors, and then may go public again through an IPO.

Shares of an IPO are typically set at an initial opening price, but market demand after the stock opens for trading will determine the stock’s price level. Demand for “hot” offerings may send their prices skyrocketing during the early days of trading.

Casual investors may be at a disadvantage when it comes to the timely purchase of an IPO, because knowledge of when a stock goes public requires constant market monitoring. Investors who were unable to purchase the stock at the initial offering price may get caught up in the stock’s euphoria and find themselves buying at inflated or astronomical price levels.

IPOs in 2022

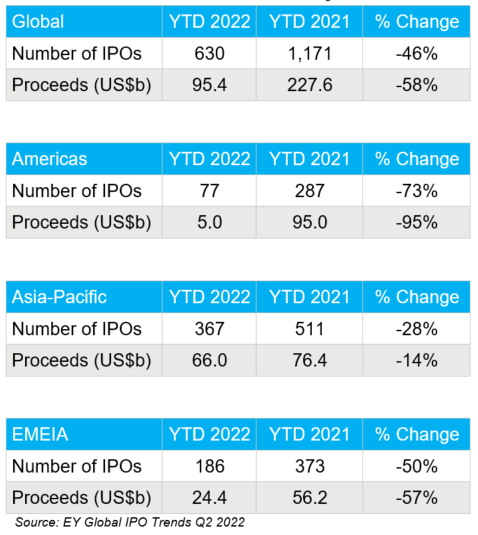

2021 was a record year for IPO activity and through the first six months in 2022, the IPO market has been dormant. In fact, global accounting firm Ernst & Young tracks IPO activity from year to year and recently released this statement: “Any initial momentum carried from a record IPO year of 2021 was quickly lost in the face of increasing market volatility from rising geopolitical tensions, unfavorable macroeconomic factors, weakening stock market/valuation and disappointing post-IPO performance, which further deterred IPO investor sentiment. With tightening market liquidity, investors have become more selective and are refocusing on companies that demonstrate resilient business models and profitable growth.”

Six-Month YTD 2022 IPO Activity

Risky Business

When companies go the IPO route, they usually do it to quite a bit of fanfare. But IPOs that rocket upward may be especially vulnerable to sharp declines. Many IPOs come back to earth, sometimes within weeks, or even days, after the opening. This may be especially true with IPOs of companies that have yet to establish a track record. Once the euphoria that carried the stock upward subsides, more sobering factors such as earnings, profitability, and fair valuation may control the stock’s flight path.

For example, in fields such as biotechnology, it can take years for new companies to actually turn a profit. In issuing an IPO, such companies are asking investors to assume significant risk in providing the working capital to carry them through the years of research and testing leading up to Food and Drug Administration approval before they can bring products to market, for example.

Since institutional investors have the inside track on many IPOs, small investors intrigued by the potential of new start-up companies may want to consider mutual funds that specialize in IPOs or small-cap stock funds that often buy IPOs.

Although it is possible to learn a great deal about a new company ready to go public from the pre-offering documents (e.g., how it plans to use the money raised), evaluating a new company’s long-term potential may be difficult because of the uncertainty surrounding its point of profitability. While investing in companies on the leading edge can offer an investor the exciting prospect of potentially large rewards, they are high-risk ventures. When considering IPOs, an investor would be well advised to let personal risk tolerance and financial objectives guide any decision to invest.

Good Advice from Warren Buffett

Investing icon Warren Buffett advocates that investors purchase stock in companies whose businesses they understand. The proviso is that investors take a sophisticated approach. Because plunging ahead, full of self-assurance, often is risky and unprofitable.

According to Buffett:

“Whenever you buy a stock … you should be able to take out a one-page sheet of paper and say: “I am buying [insert company name] at [current stock price per share] because [fill in your reason].”

If you can’t write that out, then you ought to go onto something else,” Buffett said.

“If you’re buying groceries, buying anything else, you can answer that question. But if you can’t answer it on something you’re involving your savings in for however many years for, why should you be doing it?”

That’s a great question.

Important Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be

appropriate for you, consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

Past performance is no guarantee of future results.

An initial Public Offering (IPO) is the first sale of stock by a private company to the public.

All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

This article was prepared by FMeX.

LPL Tracking #1-05306529