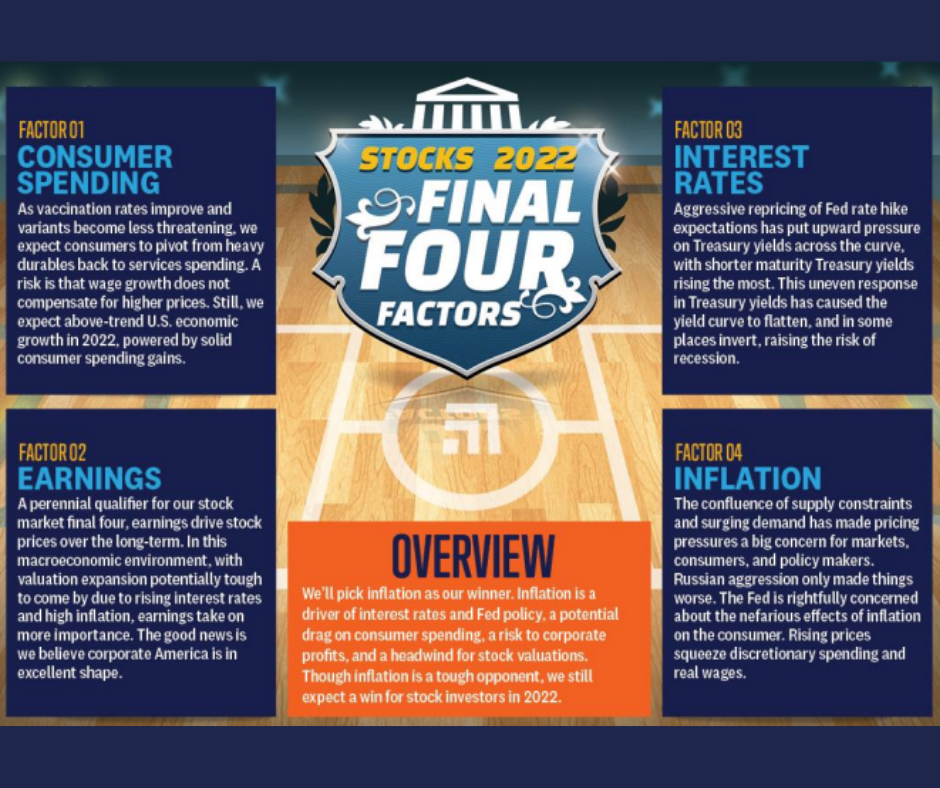

Inspired by March Madness ending this week, we have identified our four key factors for the stock market outlook: 1) Consumer spending, 2) Earnings, 3) Interest rates, and 4) Inflation. We also celebrate last year’s winner: COVID-19 vaccines. Below we discuss these four factors, how they may influence markets this year, and pick our winner. Congrats to Kansas for their win Monday night!

FACTOR #1: CONSUMER SPENDING

Consumer spending dynamics will likely play a key role for investors this year. Going into

2022, consumers were focusing on satiating their appetite for durable goods. Given pandemic related precautions, consumers focused on e-commerce opportunities to order up large-ticket

items such as furniture and recreational equipment and small items such as food and daily

personal toiletries.

As vaccination rates improve (see last year’s Final Four commentary) and variants become

less threatening, we expect consumers to pivot from heavy durables back to services

spending. In developed economies, services make up an outsized portion of total consumer

spending. Even though some services spending has recovered since the onset of the

pandemic, we have much more to go. A risk is that wage growth does not compensate for

higher prices, but consumer finances are in good shape overall, with household checkable

deposits the highest since the Federal Reserve Board started recording the data.

We continue to expect above-trend U.S. economic growth in 2022, powered by solid consumer

spending gains.

FACTOR #2: EARNINGS

A perennial qualifier for our stock market final four, over the long-term, earnings drive stock

prices. In this environment, with valuation expansion potentially tough to come by due to rising

interest rates and high inflation, earnings take on more importance.

The good news is Corporate America is in excellent shape—earnings estimates are higher in

2022 now than they were at the start of the year, which is no small feat. And high inflation has

brought pricing power to many companies along with more revenue for commodity producers.

This is evident in the double-digit revenue growth S&P 500 companies are expected to

produce in first quarter 2022 earnings season (source: FactSet).

Despite margin pressures related to supply chain disruptions and intense inflation pressures,

we believe S&P 500 companies may deliver as much as 10% earnings per share (EPS) growth

in the first quarter, compared to the current consensus estimate of about 5%. For 2022, we

believe S&P 500 earnings are on track to potentially grow mid-to-high single digits. The

roughly 2% year-to-date increase in the consensus S&P 500 EPS estimate for 2022 is an

encouraging sign.

FACTOR #3: INTEREST RATES (AND THE FEDERAL RESERVE)

U.S. Treasury yields have moved meaningfully higher this year due to the increase in Federal

Reserve (Fed) interest rate hike expectations. To start the year, bond markets were expecting

two or three rate hikes in 2022, but due to broadening inflationary pressures, markets now

expect the Fed to hike interest rates eight more times and bring the fed funds rate to nearly

2.5% by yearend. If the Fed does meet market expectations, it would be the most aggressive

start to a rate hiking campaign since 1993/94.

This aggressive repricing, however, has put upward pressure on Treasury yields across the

curve, with shorter maturity Treasury yields rising the most. This uneven response in Treasury

yields has caused the yield curve to flatten and, in some places, invert (yields on shorter

maturity securities exceeding longer maturity yields). Yield curve inversion is often looked at as

a reliable predictor of recessions. However, the more important maturities on the yield curve, at

least in terms of presaging recessions, are the three-month and 10-year yields, which are still

far from inversion.

Rates are important not only because of their usefulness as an economic signal and as a

driver of bond returns, but also because of their influence on stock valuations, as we wrote

about here last week.

FACTOR #4: INFLATION

The favorite heading into our tournament, inflation impacts will be top of mind throughout the

year. The confluence of supply constraints and surging demand has made pricing pressures a

big concern for markets, consumers, and policy makers. Russian aggression only made things

worse as commodity markets tightened amid global sanctions against one of the largest

exporters of natural gas, wheat, and precious metals. The tight labor market could play a factor

in the persistence of inflation, as wages will likely rise as firms try to attract available workers

off the sidelines. One corresponding risk in this historic environment is a potentially overly

aggressive Fed.

There are silver linings. For some, this year may hold a unique place in their life as some lucky

car owners have sold their used car for more than they paid. Who has ever heard of a vehicle

as an appreciated asset? Inflation and low interest rates have also been a boon to borrowers,

with the real value of loans falling due to inflation while interest rates remain historically low.

(And it’s not lost on us that the biggest borrower of all, the U.S. government, may be the

biggest beneficiary.) Firms with pricing power can cope with rising input costs by passing on

the cost to consumers without material impact on market share.

The Fed is rightfully concerned about the nefarious effects of inflation on the consumer. Rising

prices put a squeeze on discretionary spending and real wages. We are hopeful, but not

optimistic, that the Fed’s forecast of 4.1% inflation at yearend will be reached.

CONCLUSION

This year’s winner wasn’t as easy to call as last year, when the vaccines won in a rout. We’re

picking inflation as our winner because it’s tied so closely to the other key factors. Inflation is a

driver of interest rates and Fed policy, a potential drag on consumer spending, a risk to

corporate profits, and a headwind for stock valuations. Inflation is also difficult to predict due to

the geopolitical uncertainty in Europe and the complexity of ongoing COVID-19 effects on

supply chains and labor participation.

When we put all of these factors together, our expectation that inflation pressures will soon

start to abate, reducing the likelihood of an overly aggressive Fed, leads us to maintain our

positive stock market view. We continue to recommend a modest overweight allocation to

equities and an underweight to fixed income allocation relative to investors’ targets, as

appropriate. However, we recognize that stocks are likely to garner less valuation support at

higher interest rate levels, suggesting a slightly more cautious stance may be appropriate at

this time. Our year-end 2022 fair value target for the S&P 500 is 4,800 – 4,900.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the view s or strategies discussed are suitable for all investors or w ill yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as

predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; how ever, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values w ill decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-w eighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one w ith low er PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

This research material has been prepared by LPL Financial LLC.

Securities and adv isory services offered through LPL Financial (LPL), a registered inv estment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect tosuch entity.

Not Insured by FDIC/NCUA or Any Other Gov ernment Agency Not Bank/Credit Union Guaranteed

Not Bank/Credit Union Deposits or Obligations May Lose Value

This research material has been prepared by LPL Financial LLC.

Securities and adv isory services offered through LPL Financial (LPL), a registered inv estment advisor and broker-dealer (member

FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from

a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to

such entity.

Not Insured by FDIC/NCUA or Any Other Gov ernment Agency Not Bank/Credit Union Guaranteed

Not Bank/Credit Union Deposits or Obligations May Lose Value

RES-1113200-0322| For Public Use | Tracking # 1-05263387 (Exp. 04/23)